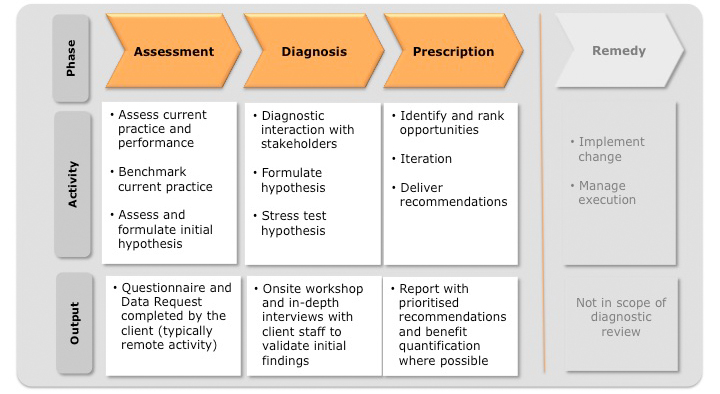

Our diagnostic healthcheck methodology typically follows a three-staged approach of Assessment, Diagnosis and Prescription, providing the client with a clear way forward to remedy the issues identified.

We undertake healthcheck diagnosis on either breadth (full business review) or depth (detailed review of specific part of the business) for both issuing and acquiring areas. Starting with a series of questionnaires and interviews, we are able to quickly analyse a client’s modus operandi, processes, resources and structures. We then compare these to the client’s expectations of performance, desired point of arrival or best practice and then provide a series of detailed recommendations to work towards the desired objectives.

Diagnostic Healthchecks

Overview

- Review an issuers current practices in respect of product distribution

- Review an issuers performance in respect of product sales

- Review sales capabilities in each distribution channel (effectiveness, efficiency, quality)

Approach

- On-site interviews with client to understand apporoach, policies and processes

- Data gathering and analysis in regards to applications, accepted applications, opened accounts, EMOB account behavior, recruitment costs by channel

Deliverables

- Detailed report on current practices identifying gaps to best practice

- Recommended actions to improve sales effectiveness, efficiency (CPA), quality and customer experience

- Recommended actions to improve EMOB account behavior

Overview

- Review of existing portfolio performance in respect of: activation, usage, balance build, revolve rates, attrition

- Review of existing portfolio financial performance in terms of income yield, losses, operating costs

- Review of existing practices in respect of customer segmentation, EMOB and tenured customer management

Approach

- On-site client review – interviews to understand current processes, policies and practices

- Data gathering to enable detailed understanding of portfolio performance, customer behavior and segmentation exercise

Deliverables

- Detailed report on current portfolio performance

- Recommendations related to customer segmentation, EMOB and Tenured Customer Management

- Recommendations related to improving portfolio yield (pricing, fee application)

Overview

- Review of entire customer journey from acquisition, through life-of-account to attrition / closure

Approach

- On-site client review – interviews to understand current processes, policies and practices

- Gathering of any existing process maps

- Gathering of any existing customer sataifaction data / surveys

- Optional mystery shopping

Deliverables

- Documented existing customer journey in form of process map

- Commentary on all customer touchpoints, their range of experiences

- Recommended actions to improve customer journey and its effectiveness / efficiency

- Outcomes from mystery shopping (optional)

Overview

- Review of effectiveness of existing (or proposed) loyalty program (on credit or debit)

Approach

- On-site review with client to understand current portfolio performance, characteristics of loyalty program and behavior / profitability of customers at segment level

- Analysis of portfolio perfomance data, cost of loyalty, earn and burn rates

- Analysis of alternative structures to program

Deliverables

- Detailed overview of currnent reward program performance

- Recommendations as to how desired client outcomes can be achieved (e.g reduced cost, greater engagement, greater redemption etc.)

- Recommendations as to alternative means of rewardinfg customers / driving loyalty